property tax on leased car connecticut

Under Connecticut state law CGS 12-8153 one passenger motor vehicle belonging to or held in trust for any member of the United States. For vehicles that are being rented or leased see see taxation of leases and rentals.

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

It is an annual assessment on personal property by the state and since BMWFS would own the car they would get the bill.

. No tiene Productos en su Cesta de la Compra. The taxing process for motor vehicles is the same for other taxable property in Connecticutthe tax rate of the property is assessed at 70 of fair market value which is determined by a local assessor. Excise taxes in maine massachusetts and rhode island.

Do you pay property taxes on a leased car in ct. And motor vehicle registration fees in New Hampshire. To learn more see a full list of taxable and tax-exempt items in Connecticut.

You are a Connecticut resident AND Paid qualifying property tax on your PRIMARY RESIDENCE ANDOR MOTOR VEHICLE during 2021 AND One or both of the following statements apply. Excise taxes in Maine Massachusetts and Rhode Island. The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or dealer.

While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. When you lease a vehicle the car dealer maintains ownership.

The number of motor vehicles eligible for. The rate is also determined by the local municipalities so it varies from one area to another according to the state. Finally 20 states impose no state or local taxes on motor vehicles or motor homes.

If you do pay the personal property tax you can deduct it. This page describes the taxability of leases and rentals in Connecticut including motor vehicles and tangible media property. Generally property tax bills due and paid during 2017 qualify for this credit.

Arkansas Connecticut Kentucky Massachusetts Missouri North Carolina Rhode Island Texas haha I always found it funny how when you flip the A and the E in Texas you get Taxes LOL Virginia West Virginia and. I was surprised to see a mail from my leasing company GMAC to pay personal property tax on my leased car. Quick question to any CT Lease holders or dealers.

Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract. Does BMWFS bill back the cost of the annual personal property tax in Connecticut to the lease holder. While people with general questions about the states property taxes can contact the Office.

If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. In addition to taxes car purchases in Connecticut may be subject to other fees like registration title and plate fees.

Many of Connecticuts 74 municipalities with independent taxing districts incorrectly assess taxes on leased automobiles because the state Department of Motor Vehicles does not provide them with. As soon as I moved my lease payment went. However they could issue a lease contract that says that the lessee is solely responsible.

There are different mill rates for different towns and cities. You or your spouse are 65 years of age or older by the end of the taxable year. You may take credit against your 2017 Connecticut income tax liability for qualifying property tax payments you made on your primary residence privately owned or leased motor vehicle or both to a Connecticut political subdivision.

To be clear this is different than the sales tax on the sale of the car. Yes you may take a credit against your 2016 Connecticut income tax liability for qualifying property tax payments you made to your Connecticut town or taxing district on your privately owned or leased motor vehicle or both. Do you pay taxes on a leased car in ct.

For vehicles that are being rented or leased see see taxation of leases and rentals. Max_g may 23 2019 627pm 6. You may use this calculator to compute your Property Tax Credit if.

Do you pay taxes on a leased car in ct. Can I Move My Leased Car Out Of State - Movingcom. I leased this car from IL and moved to CT zip 06810 Danbury last Sept.

Local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise. Heres how it works. The Assessor may require you to submit motor vehicle lease verification.

For Connecticut Resident on Active Military Duty. You may take a personal property tax deduction for the applicable amount varies by state for any vehicle you pay this tax for. They are not subject to local taxes.

Motor Vehicles are subject to a local property tax. Some municipalities give the option of paying the bill in installments. According to Connecticuts Department of Motor Vehicles DMV you must pay a 635 percent sales tax or 775 percent sales tax on vehicles over 50000 upon the purchase of your vehicle from a.

Leased and privately owned cars are subject to property taxes in Connecticut. Motor Vehicle Property Tax Exemption or Benefit Application. This means you only pay tax on the part of the car you lease not the entire value of the car.

The maximum credit allowed on your motor vehicle is 200 per return regardless of filing status. You can find these fees further down on the page. CITY OF STAMFORD Assessors Office 888 Washington Blvd Stamford CT 06901 Tel.

170 rows Town Property Tax Information. Failure to file by the deadline constitutes waiver of the right to claim the property tax exemption or refund for which CGS 12-8153 provides. A mill rate is the rate thats used to calculate your property tax.

To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000. However the state has an effective vehicle tax rate of 26 according to a. Later than the thirty-first day of December next following the date the property tax is due.

In most cases the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the. CONNECTICUT Connecticut car owners including leasing companies are liable for local property taxes.

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

What S The Car Sales Tax In Each State Find The Best Car Price

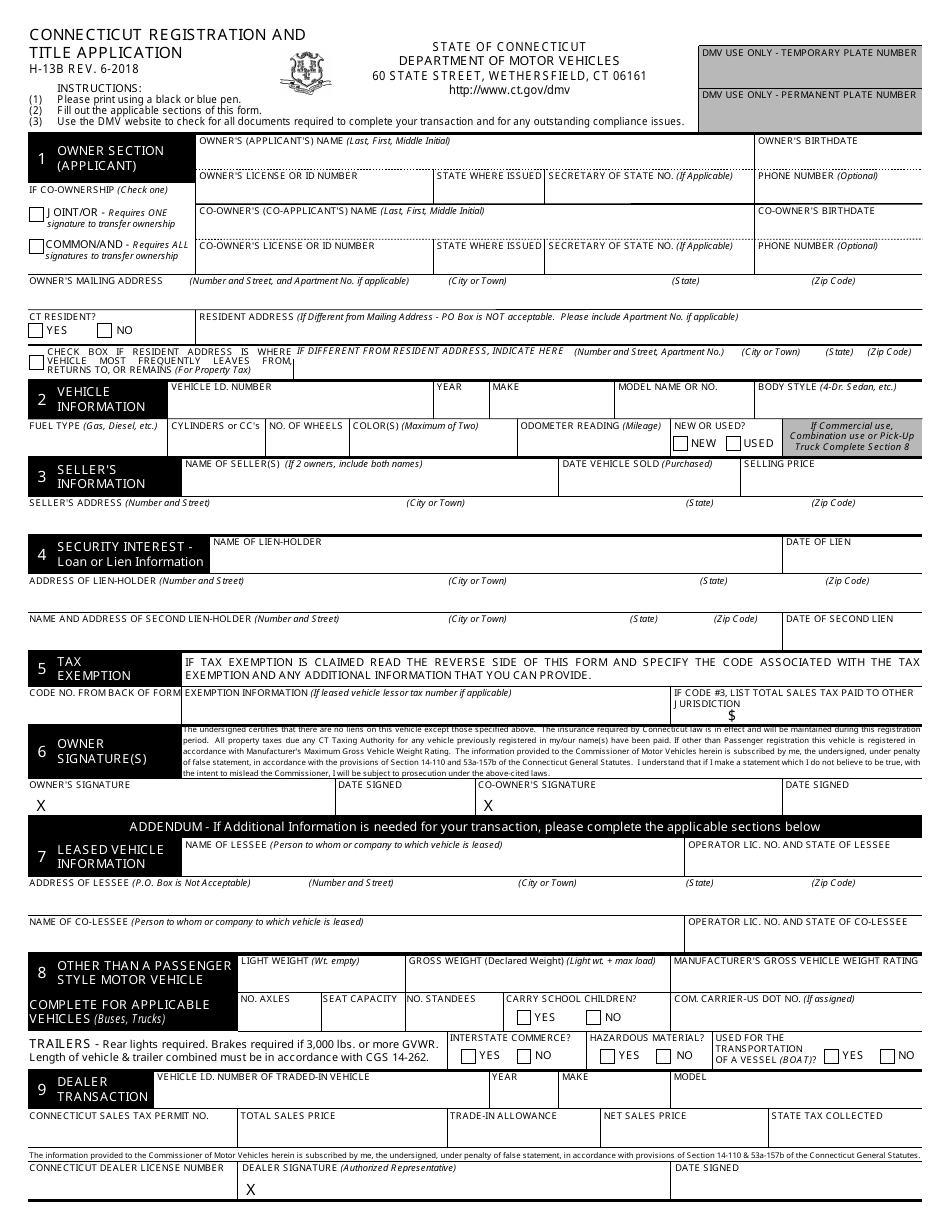

Form H 13b Download Fillable Pdf Or Fill Online Connecticut Registration And Title Application Connecticut Templateroller

Free Vehicle Lease Agreement Free To Print Save Download

Which U S States Charge Property Taxes For Cars Mansion Global

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz